News

International Cannabis Network News

Commercial real estate booms in cannabis-friendly states

Cannabis

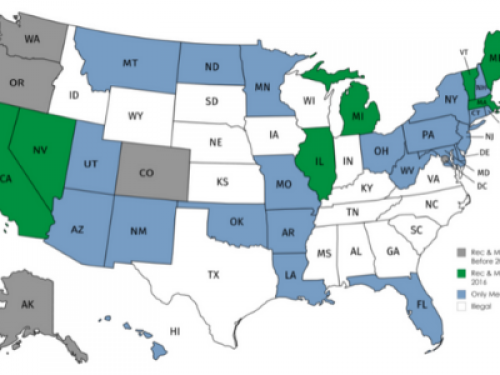

In a reversal from 2018 trends, cannabis investors are buying up commercial property, particularly warehouses, in states where recreational cannabis use has been legalized for more than three years, according to a new study by the National Association of Realtors, based on a September 2019 survey of over 600 commercial brokers in states like Colorado, where recreational cannabis use is legalized, and in states, like Florida, where medical marijuana use is legal.

“It is very important to understand the supply and demand, and the regulatory dynamic, in each state. Focusing on states with higher barriers to entry makes a license more valuable and makes that real estate more valuable,” said Katie Barthmaier, chief executive officer of Green Acreage, a cannabis-focused real estate investment trust.

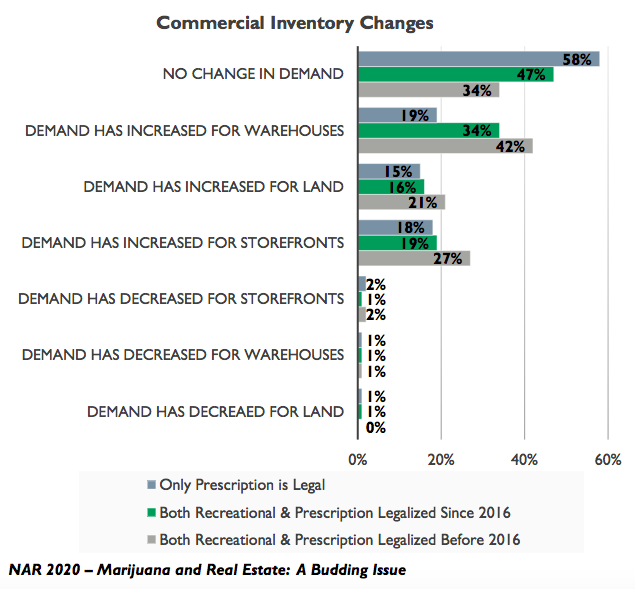

Warehouse demand increased in 42% of the markets with longstanding (over three years) recreational legalization, and 34% of markets that legalized recreational use since 2016 also saw increased demand from the previous year. Only 18% of markets without recreational marijuana legalization claimed warehouse demand growth.

In 2018, warehouse demand in states with only medical use outpaced demand in states with recreational use, 34% to 27%, respectively, according to last year’s study.

“In states that have a longstanding legal [cannabis] industry, warehouses have especially been of interest to commercial investors. That increased demand, I suspect is not just for storage but for growing,” said Dr. Jessica Lautz, vice president of demographics and behavioral insights for the National Association of Realtors.

Meanwhile, demand for retail space increased in 27% of longstanding recreation-friendly markets (before 2016), compared to 19% of recently-legalized markets or 18% of prescription-only markets. The trend is a reversal from 2018, when storefronts saw greater growth in medical use-only markets than in markets with recreational use.

“Investors knew folks would need space to cultivate and manufacture cannabis. A lot of unused space was rented up and bought by investors,” said Jack Nichols, general counsel and chief operating officer of Harborside, a Calif.-based marijuana company. Nichols said that cannabis investor interest has inflated real estate prices as demand for commercial space grows.

Read More at source: Yahoo Finance

Image Source: Yahoo Finance